tax break refund unemployment

Use an existing User ID if you already have one for another TWC Internet system. This threshold applies to all filing statuses and it doesnt double to.

Some Taxpayers Can Expect Refunds After Covid 19 Relief Bill Gave Unemployment Tax Break 2news Com

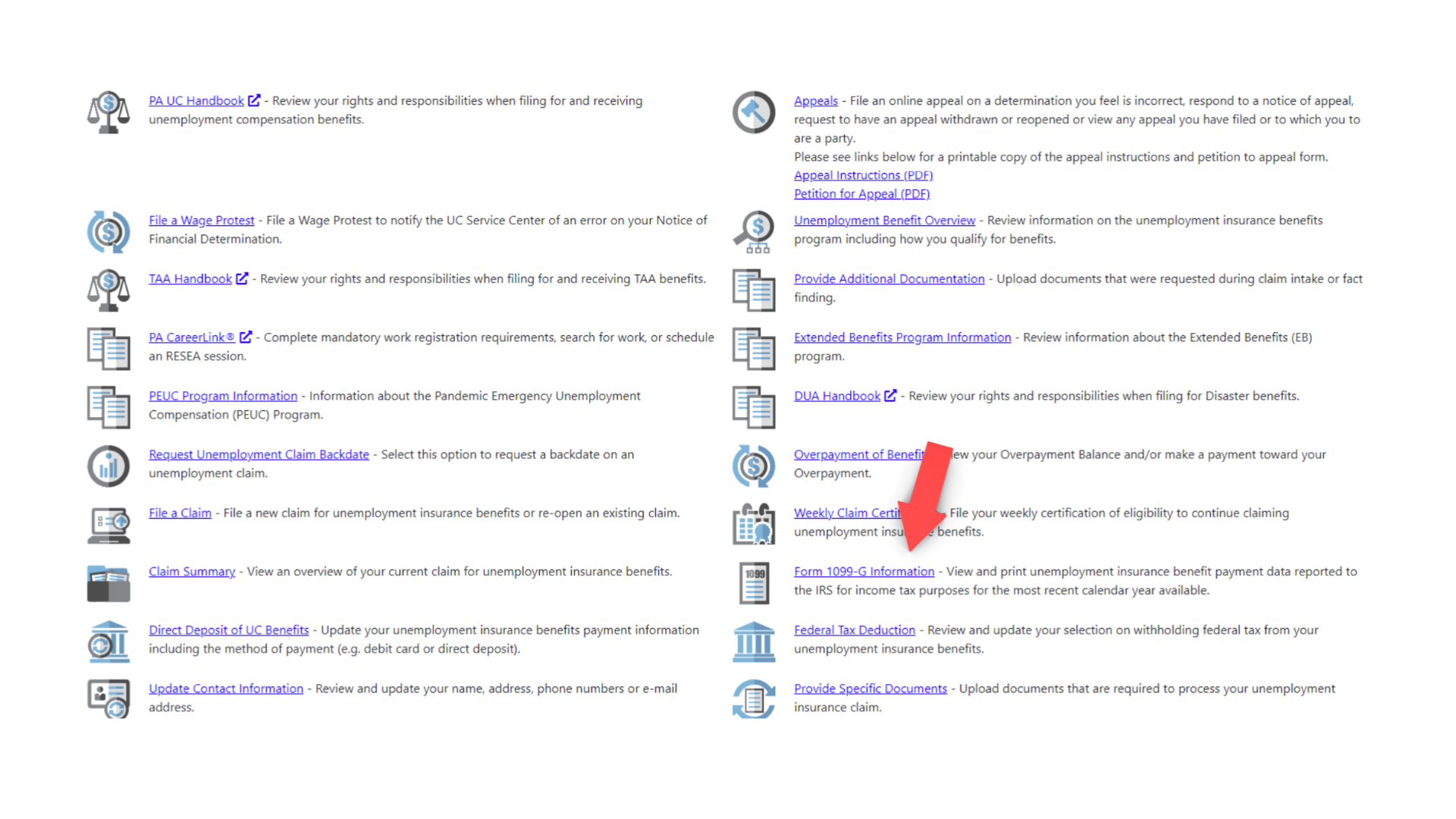

Submit quarterly wage reports for up to 1000.

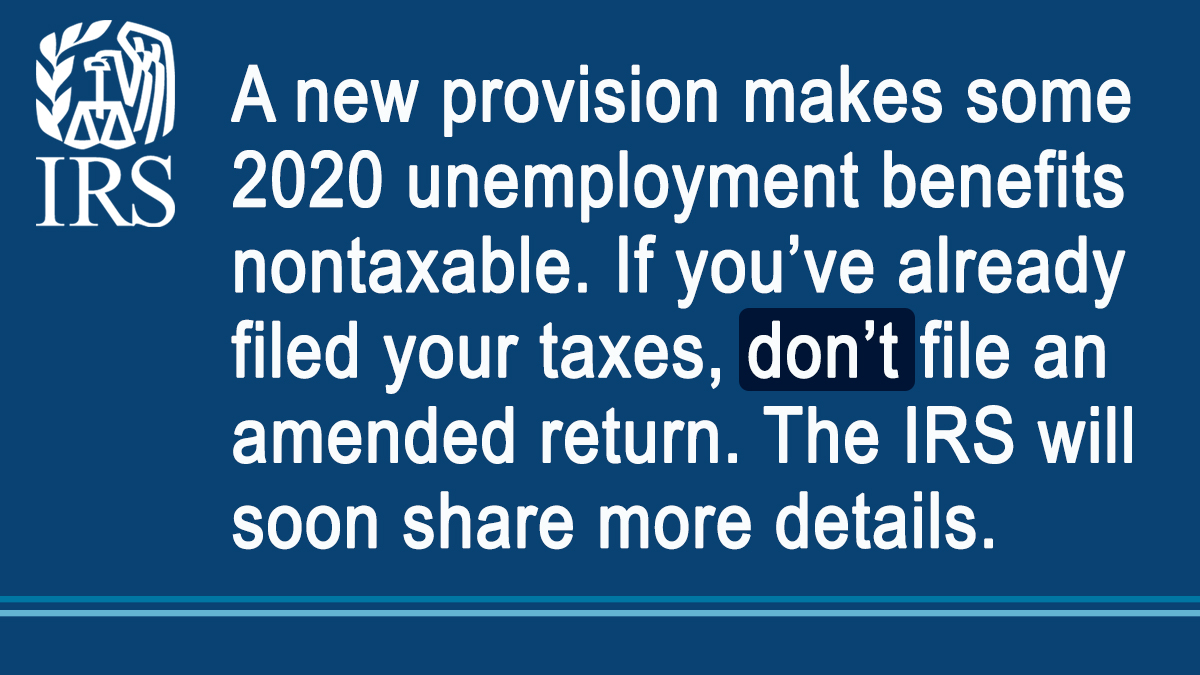

. Unemployment 10200 tax break. This means that you dont have to pay federal tax on the. The first10200 in benefit income is free of federal income tax per legislation.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Tax season started Jan. The IRS has sent 87 million unemployment compensation refunds so far.

There are more tax problems for some people who filed for unemployment benefits last year. Online tax preparers like TurboTax and HR Block havent. 24 and runs through April 18.

Using Unemployment Tax Services. Unemployment Federal Tax Break. Who died on mount hood 1986.

Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment. 1222 PM on Nov 12 2021 CST. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

The IRS announced earlier this month that the agency had begun the process of adjusting tax. The IRS began to send out the additional refund checks for tax withheld from unemployment in May. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

Dec 30 2021 What are the unemployment tax refunds. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid.

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. If you requested a refund of tax withheld on a Form 1042-S PDF by filing a Form 1040NR PDF allow up to 6 months from the original due date of the 1040NR return or the date. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The federal tax code counts. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. Blake Burman on unemployment fraud.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The agency issued tax refunds worth 145 billion to over 118 million households as of Dec. The IRS will continue the process in 2022 focusing on more complex tax returns.

This is the fourth round of refunds related to the unemployment compensation. Refunds set to start in May.

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment 10 200 Tax Break Some States Require Amended Returns

Unemployment Benefits Tax Issues Uchelp Org

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com

What You Should Know About Unemployment Tax Refund

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson