tax exempt blanket certificate ohio

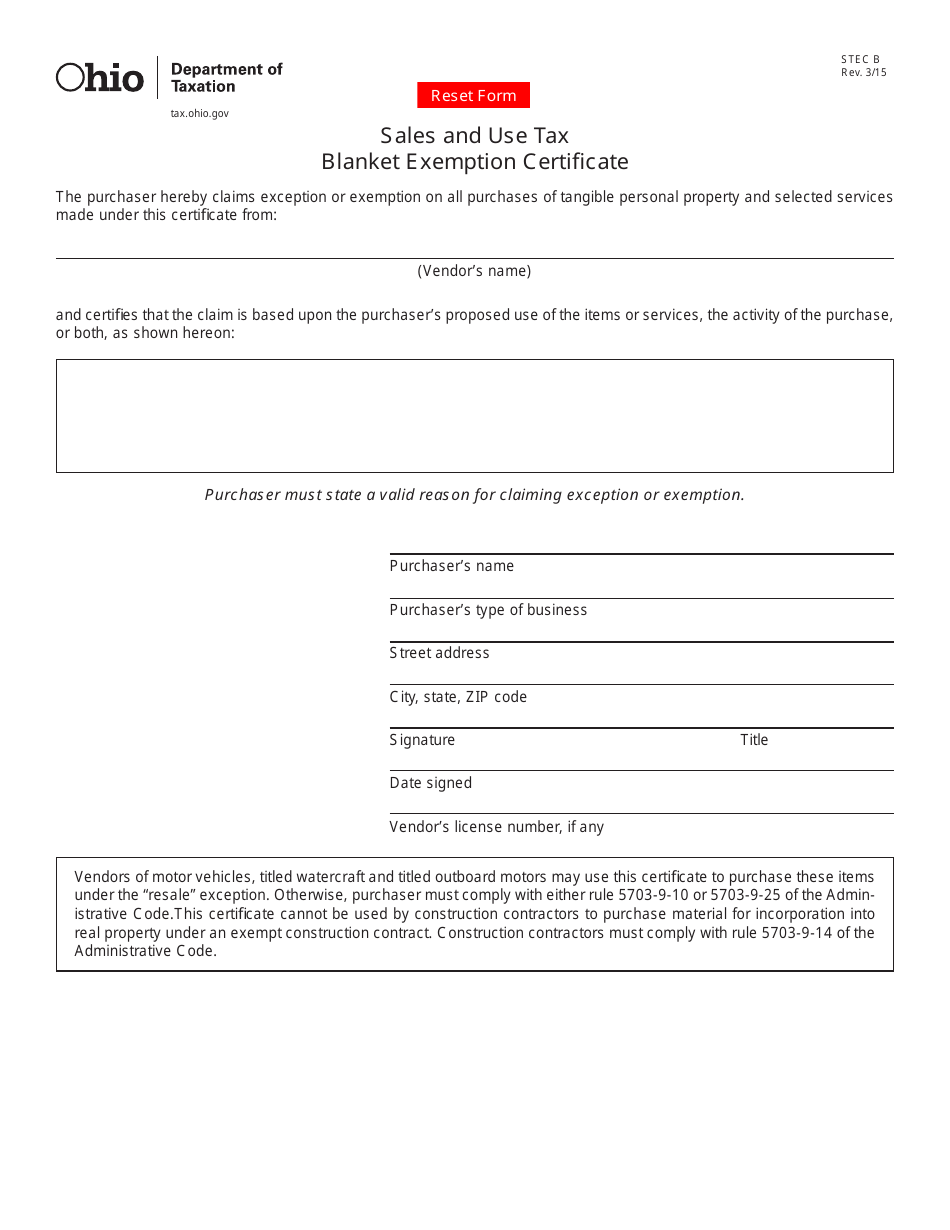

The contractor may use a blanket exemption certificate which covers all purchases from that vendor unless specified otherwise or a unit exemption certificate which only covers a single purchase. Enter the Vendors name 2.

Ohio Resale Certificate Trivantage

If the box is not checked this certificate is considered a blanket certificate and remains effective until cancelled by the purchaser if purchases are no more than 12 months apart unless a longer period is allowed by.

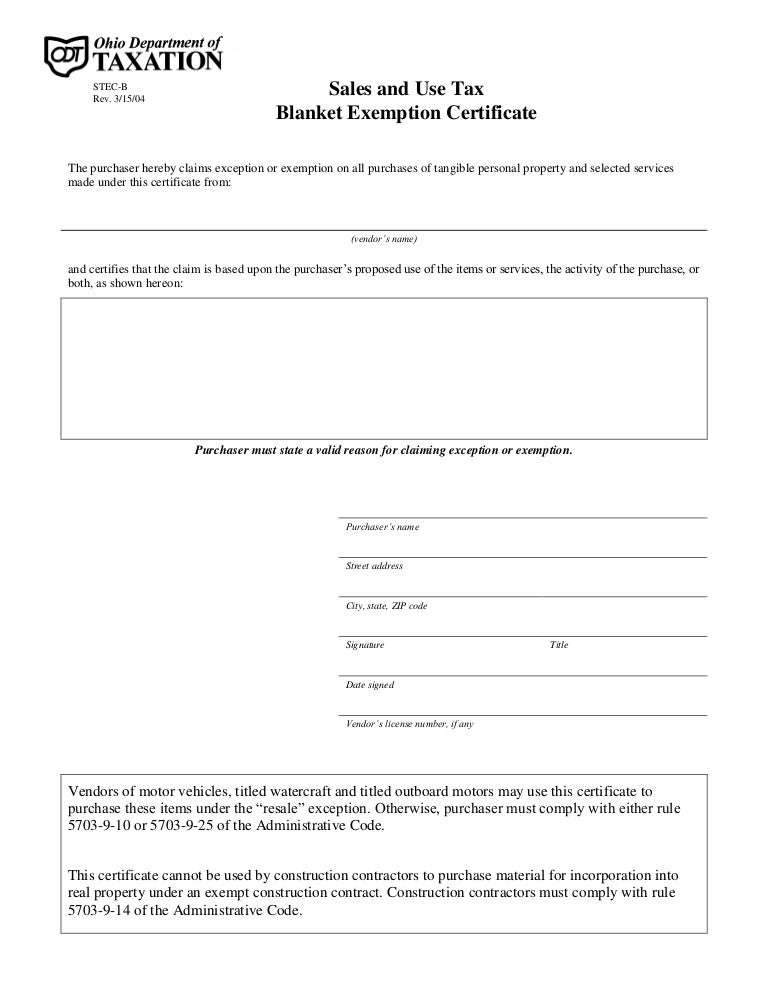

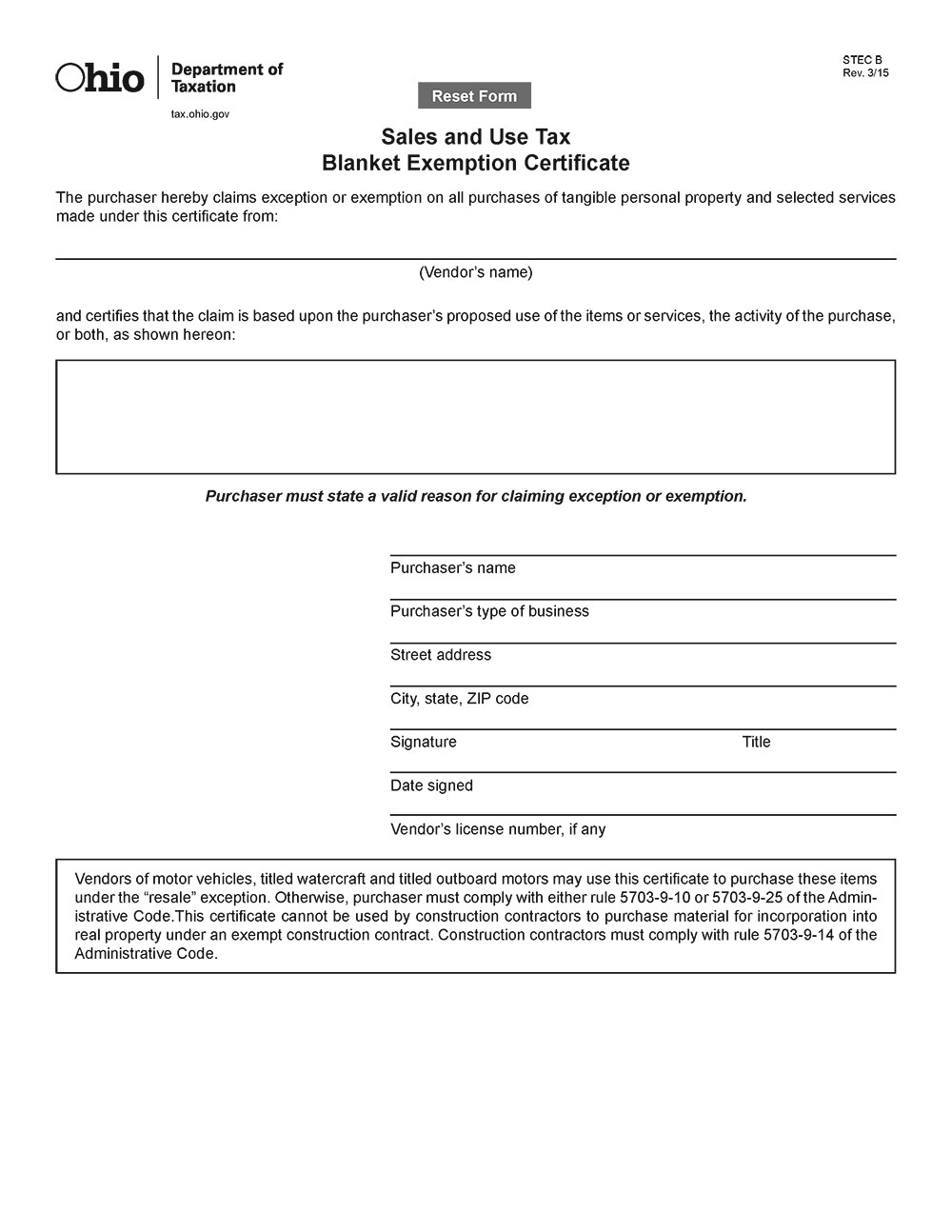

. Customer Reviews 0 769A3 - Ohio Blanket Certificate Of Exemption Revised 2014 Size. 100 forms per pad. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from.

You can use the Blanket Exemption Certificate to make. This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Ohio sales tax.

Assuming the contractor will make future taxable purchases from the supplier of materials to be incorporated. A new certificate does not need to be made for each transaction. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now.

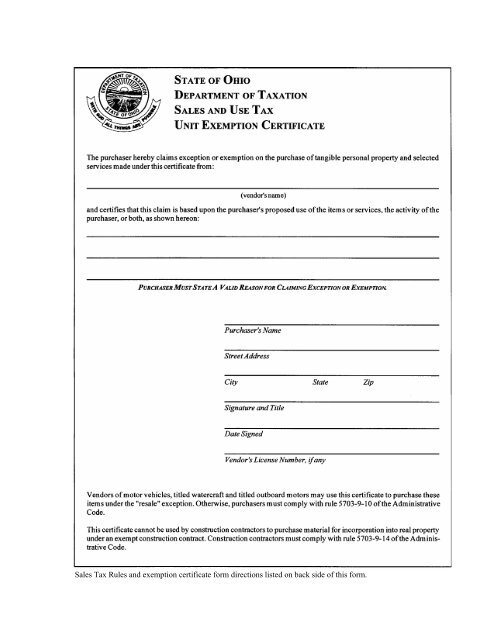

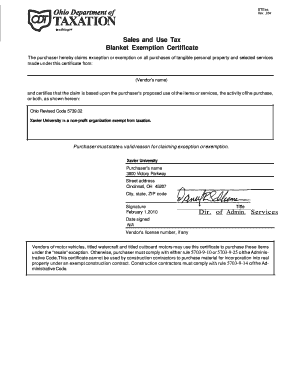

If you have tax exempt status please. This exemption only applies to the 4-H clubaffiliate and does not extend to individual members or volunteers. STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from vendor s name and certifies that the claim is based upon the purchaser s proposed use of the items or.

Sales and Use Tax. Sections 16 are required information. Ohio does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re-used for all exempt purchases made from that vendor.

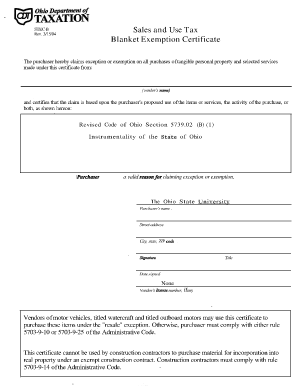

The Ohio State University Sales and Use Tax Blanket Exemption Certificate Instructions Page for Fillable PDF Form Please follow the instructions below prior to sending the Sales and Use Tax Blanket Exemption Certificate to any vendors. Most state sales tax exemption certificates do not expire and the seller is required to maintain exemption certificates for as long as sales continue to be made to the purchaser and sales tax. Vendors name and certifi or both as shown hereon.

Vendors name and certifies that the claim is based upon the purchasers proposed use of the items or services the activity of the purchase or. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from.

This exemption only applies to the 4-H clubaffiliate and does not extend to individual members or volunteers. Sales and Use Tax Blanket Exemption Certificate. Construction contractors must comply with rule 5703-9-14 of the Administrative Code.

Consolidated Plastics only collects sales tax for items shipped to certain states. Sales and Use Tax Blanket Exemption Certificate. Ohio Blanket Tax Exempt and Unit Exemption Certificates.

Sales and Use Tax Blanket Exemption Certificate. This form exempts ODOT from sales and use tax under Ohio Revised Code Section 573902 B-1. Complete the form as follows.

Sales and Use Tax Blanket Exemption Certificate. View unit pages for individual locations Admin. Enter the date 3.

For other Ohio sales tax exemption certificates go here. 8 12 X 11. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from.

Vendors name and certifi or both as shown hereon. A signature is not required if in electronic form. This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract.

Blanket Tax Exemption Form. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. You can download a PDF of the Ohio Blanket Exemption Certificate Form STEC-B on this page.

Download the appropriate certificate below Fill out the Sales and Use. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. Ohio 4-H Youth Development and Chartered Ohio 4-H clubsaffiliates are exempt from paying Ohio sales tax on items they purchase for their group because they are a not for profit organization.

Ohio sales and use tax blanket exemption certificate pdf. 108 Bricker Hall 190 North Oval Mall Columbus Ohio 43210. STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from vendor s name and certifies that the claim is based upon the purchaser s proposed use of the items or services the.

September 01 2020 Agency. Ad Tax Exempt Certificate. Purchaser must state a valid reason for claiming exception or exemption.

Vendors name - the business you are purchasing from Valid Reason Revised Code of Ohio Section 573902 B9 To conduct Ohio 4-H Youth Development educational. Ohio Sales Tax Exemption Certificate. Office of Business and Finance.

Use the yellow DOWNLOAD button to access the exemption form. Purchaser must state a valid reason for claiming exception or exemption. Sales and Use Tax Blanket Exemption Certificate.

Check the box for a single purchase and enter the invoice number. Ad STF OH41575F More Fillable Forms Register and Subscribe Now. Complete the form as follows.

Fill Free Fillable Forms State Of Ohio

Blanket Certificate Of Exemption Ohio Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Free Form Sales And Use Tax Blanket Exemption Certificate Free Legal Forms Laws Com

Farm Bag Supply Supplier Of Agricultural Film

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Fill In Blank Tax Exemption Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Ohio Tax Exempt Form Holland Computers Inc

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Form Stec B Fillable Sales And Use Tax Blanket Exemption Certificate

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Ohio Farming Blanket Exapmtion Certificate Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com